The highest value painting sold at auction was Leonardo da Vinci’s portrait of Christ, Salvator Mundi for $450.3m. But the finance of Art is seldom so lucrative and unfortunately works will frequently only increase in value when the artist dies.

The Artist

For many Art is a secondary source of income, a chance to share their passion by selling a few pieces they have produced in galleries, online or at events like Art on the Prom. In the past even tiny profits would have been taxable, but HM Revenue & Customs have now introduced a trading allowance of £1,000 as a notional expense for small trades. An artist earning no more than £1,000 in sales in a year will have no reporting requirements on a Tax Return. If the artist earns more than £1,000, and their actual expenditure in the year is below £1,000 they can claim it instead.

Art is also frequently a feast and famine pursuit. There are provisions for loss relief in certain situations and it is even possible to average profits over two tax years in some cases.

The Collector

Art Collectors will be liable to tax when they sell pieces, but sales could be treated as trading profits, or a capital gain dependant upon how they carry out their dealing with significant differentials in tax rates to apply.

If you inherit a work of art generally this will be liable to inheritance tax within the deceased estate. However, there are exemptions for National Heritage Assets but these are works of significant artistic interest and must be kept in the UK and made available for the general public to view in order to obtain the exemption. This is another reason you might see that artworks have been donated to galleries to ensure that this exemption applied on inheriting the piece. Likewise selling a work of art can give rise to a capital gain, but if sold to a gallery an exemption from tax can arise.

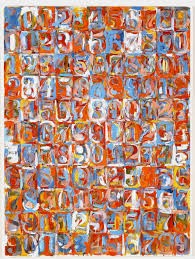

Numbers in Color is a painting by Jasper Johns in 1959. He explained that numerals—from zip codes to social security identification—organize our lives in a variety of ways but are, in fact, only ideas; they are not tangible things.

Enjoy Art on the Prom, and if you are an artist or an Art Collector and would like to know more about minimising your tax burden please contact mandy@beatons.co.uk or call 01473659777 to arrange a no obligations meeting.