It’s Wimbledon fortnight and that can only mean one thing – kerching!

Well, OK - the tennis, the strawberries and the odd centre court tantrum are really what it’s all about.

But for the thousands of homeowners in and around the Wimbledon area there’s cash to be made as fans flock to see the sporting action.

That’s because there’s a surge in demand for short lets around that time and traditionally many property owners rent out rooms or their whole house, to those in town for the tennis.

And it’s not just rooms that command a price for those two weeks in July. Garages and driveways can be in demand too as drivers look for a secure spot to park up.

Sounds like a ‘win-win’ all round, doesn’t it?

But while it’s true that renting out space can be lucrative, you do need to make sure it’s not game, set and match in favour of HMRC.

So, what are the rules?

Head of taxation at Beatons Andrew Diver serves up a few pointers to keep things at ‘love all’.

And it’s not just about the Wimbledon fortnight – these top tips apply to any property owners thinking of letting out space at any time of the year.

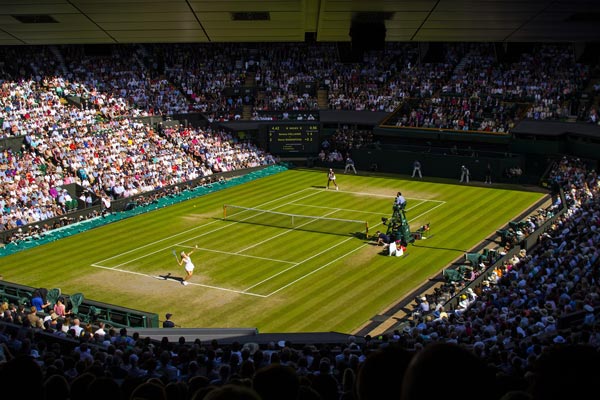

Image by davidkenny91 from Pixabay

Declare the income

“Many people might think that because they’re letting space for a short time only, they don’t need to tell HMRC,” says Andrew “But it’s not worth it, as they will find out.”

HMRC can obtain information directly from letting sites such as Airbnb, Vrbo, or general estate agents as well as via targeted online searches.

So, if you have used any of the usual methods of engaging with potential tenants, the chances are HMRC will uncover it if they want to.

Andrew adds: “While I’m not sure HMRC’s reach has extended to monitoring the newsagents’ windows – when it comes to Wimbledon residents in particular, it wouldn’t surprise me if they have a revenue officer taking a stroll through the local area before and during the Wimbledon fortnight so leave nothing to chance and stay on the right side of the rules.

“The declaration of income should be made using an SA1 form notifying HMRC you have a liability to tax.”

It’s worth knowing that failure to notify penalties can apply as well as further tax geared penalties for late payments.

“HMRC can gather information in all sorts of ways,” says Andrew “Even obtaining details of individuals’ club card or grocery purchases from supermarkets, as well as travel plans, so you can believe they will find out even if they don’t close the net immediately.”

Are there any allowable costs?

Historically those wishing to make a quick pound on renting out rooms during Wimbledon could claim the ‘rent-a-room relief’ which exempts up to £7,500 of rental income each year when you let a room.

“While this is still possible, it’s important to note one very key point,” explains Andrew “From April 2019 the rules changed, meaning that this can only be claimed if the homeowner is also present during the time of the let. This means that anyone renting out a room during Wimbledon who then heads off on holiday cannot take advantage of the exemption.”

“Some property owners might still believe that the rent-a-room relief applies and could fall foul here.”

Though this can be tricky for HMRC to validate it is likely that officers can obtain information regarding flights overseas to determine whether a landlord or homeowner was in the country or not.

It’s also good to know that if the property is jointly let, the £7,500 rent-a-room exemption (providing you’re also in residence at the time) is not per person or homeowner. It is reduced to £3,750 each and therefore splitting income doesn’t have a great effect unless you have different marginal rates of tax.

Can expenses be claimed?

If you do decide to head off on holiday while renting out a room then you need to look at any expenses you could claim.

“There’s a good chance that for a fortnight your expenses might not exceed £1,000 so in that case you could claim the property income allowance,” says Andrew.

“The property allowance is a tax exemption of up to £1,000 a year for individuals with income from land or property. And If you own the property jointly with others, you’re each eligible for the £1,000 allowance against your share of the gross rental income.

“This helps you to split the income between spouses for example and the relief gives you spending cash for a holiday, at least.”

This allowance can also be claimed by those who rent out a driveway for parking.

“Do note though that when you claim the property income allowance you can’t deduct any other expenses so you have to choose which works better for you. We can advise on the best course of action if you’re not sure.” Adds Andrew.

For more information and advice about your specific situation please contact us info@beatons.co.uk or call 01473 659777.